Aug 24, 2024

The Mortgage Help Benefit: A Path to Better Employee Outcomes

Employer Solutions

In today’s economy, employees look for ways to save money and optimize investments. This renewal season, there’s MHB, a voluntary debt relief benefit to help employees save time and money repaying their mortgage.

MHB enables employees to use some workplace savings plan contributions to make monthly mortgage ‘pre-payments’. This innovative option for improving an employee’s ROI is gaining traction, here’s why.

1. Higher Effective Returns

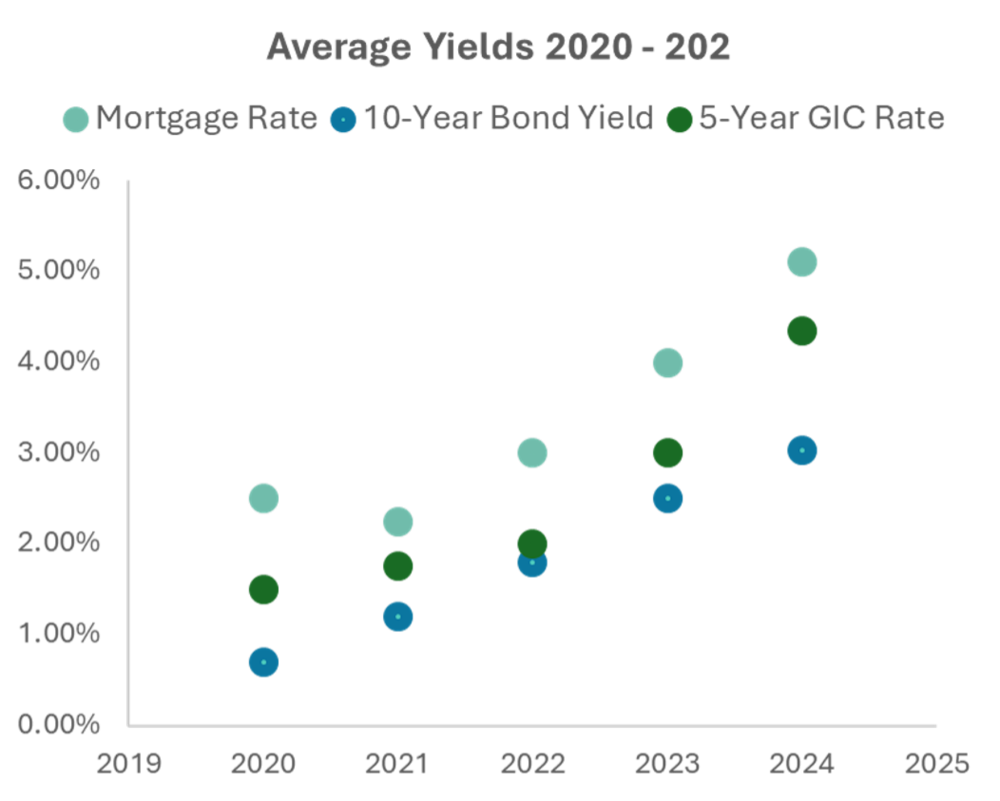

Mortgage Pre-Payment - By pre-paying a mortgage, you effectively earn a return equivalent to your mortgage interest rate. For many, this rate has been around 4.5% to 5.5% in recent years. This is a guaranteed return, as it directly reduces the amount of interest paid over the life of a mortgage.

Fixed Income Investments - Historically, fixed income returns have been lower. For example, Canadian 10-year government bonds averaged around 3.7% in the 2010s, but recent returns have been negative (-3.5% from 2020 to 2023). Short-term investments like 90-day T-Bills have also offered modest returns, averaging around 0.9% in the 2010s and 1.8% recently.

With MHB - The guaranteed return from pre-paying your mortgage (4.5% to 5.5%) will generally be higher than the returns from fixed income investments, making it a more attractive option for those looking to maximize their savings.

2. Good Alternative to Conservative Investments

A conservative growth portfolio commonly includes a combination of equities and fixed-income securities such as bonds and Guaranteed Investment Certificates (GICs). This blend aims to balance growth and capital preservation for the purpose of providing income generation in retirement.

Conservative Portfolio Components - Typically, the conservative portion of a portfolio is invested in low-risk bonds, GICs, low-volatility fixed-income ETFs and mutual funds. These investments are designed to provide stability and preserve capital yet often offer lower returns.

With MHB - By reallocating funds from a portion of the fixed income component of a portfolio, an employee participant in MHB can achieve higher effective returns. The guaranteed return from reducing mortgage interest (4.5% to 5.5%) often surpasses the returns from low-risk bonds and GICs, making it a compelling alternative for the conservative portion of a portfolio.

3. Flexibility and Control

MHB is an optional benefit that can be adjusted to an employee’s specific situation. Monthly pre-payment amounts such as, $100 or $200 each month, may be modified as interest rates and personal circumstances change.

For Your Clients

Debt relief benefits offer your clients an innovative complement to a group savings plan with easy implementation and low admin. Employees enjoy the help, the flexibility and the improved outcomes. Employers appreciate the exceptional retention rates of debt relief programs - 100% for MHB and 98% for student loan programs.