Jul 12, 2023

Proactive Employers Stepping Up

Employer Solutions

Proactive Employers Stepping Up

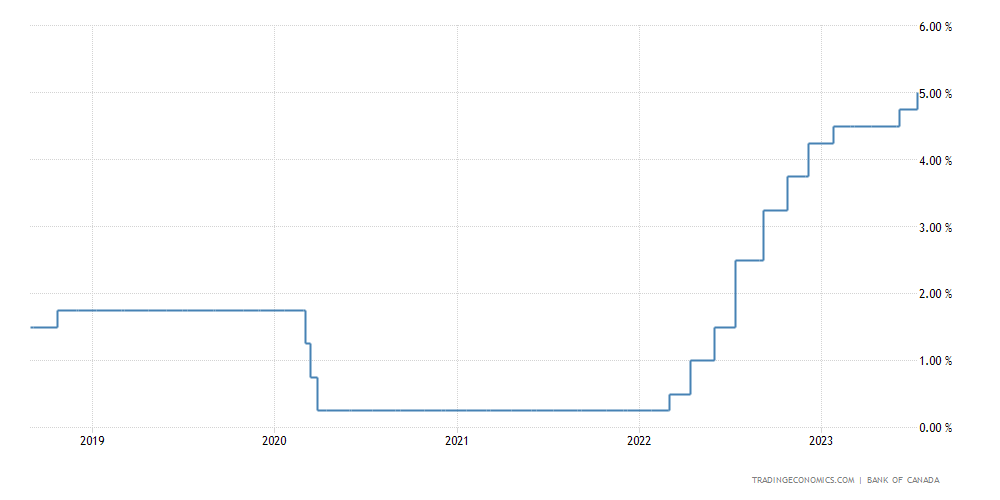

Climbing interest rates and rising prices on everyday essentials have led to an affordability crisis, affecting personal finances and overall employee wellbeing and productivity.

Recognizing the challenges employees face, forward-thinking employers are taking proactive steps to address employee financial health by offering debt relief benefits. With debt relief benefits for student loans or mortgages, employers can significantly improve the financial wellness of their workforce.

The Affordability Crisis

The rising cost of living creates financial strain on employees. As interest rates increase, debt becomes more expensive to repay, leaving many Canadians struggling to make ends meet. Student loan debt and mortgage payments can weigh heavily on employees, blocking their ability to save, invest, even plan for the future.

The Role of Employers

Employers are in a unique position to support their employees' financial well-being. By introducing debt relief benefits into Total Rewards initiatives, they demonstrate a commitment to the whole person. These benefits go beyond traditional compensation packages and contribute to a positive work environment, encouraging loyalty and productivity among employees.

Tailoring Benefits to Employee Needs

Every workforce is unique. Employers are customizing their debt relief programs to meet the specific needs of their employees while staying true to corporate objectives. They conduct surveys or informal polling to identify areas where employees would benefit from additional support. This approach ensures the offerings align with employee challenges, maximizing their impact and creating positive and lasting impact on employee financial well-being and corporate culture.

Long-Term Gains

With the addition of debt relief rewards, employers reduce immediate financial stress and contribute to the long-term financial stability of their employees. Reduced debt burdens result in increased disposable income and improved credit scores. Employees are empowered to better manage their finances, make sound financial decisions and invest in their future, ultimately leading to a more financially secure and engaged workforce.

Student Loan Help

Student loan debt has reached staggering levels, impacting the financial stability of millions of individuals. Employers are easing this burden with student loan repayment help -through direct contributions or matching employee payments, employers are helping speed up repayment, reduce interest costs, and empowering employees to achieve financial freedom sooner.

Mortgage Help

Homeownership is a cornerstone of financial stability, but unforeseen circumstances and/or rising interest rates can strain mortgage repayment obligations. Employers can provide valuable assistance with mortgage help programs. These benefits may include temporary relief options during financial hardships, or counselling services to help employees navigate their mortgage-related concerns.

Canadian Interest Rates over Time

Conclusion

Amid serious economic challenges and mounting debt burdens, employers have an exceptional opportunity to support the financial wellness of their employees. By offering debt relief benefits, such as student loan and/or mortgage repayment help, employers demonstrate a commitment to the financial well-being of their workforce. These powerful benefits alleviate financial stress and enable employees to focus on their work, boost productivity and achieve long-term financial stability. Through their actions, employers foster a culture of financial health and empowerment, ensuring the success and happiness of their employees and in turn, helping ensure the success of the business.